The Best Way to Apply for Opay Merchant Loan in Nigeria (2024)

The Best Way to Apply for Opay Merchant Loan in Nigeria

There are so many financial institutions that offer online loan services that have the fastest and easiest way to access credit loans in Nigeria, you do not need any collateral or guarantor to access the loan. This article will reveal the Best Way to Apply for Opay Merchant Loan in Nigeria.

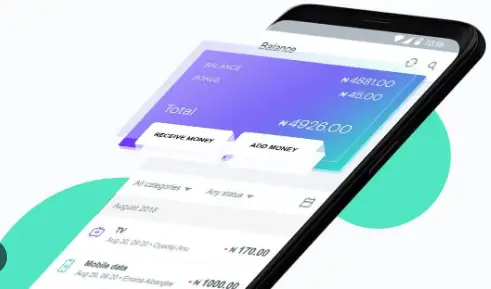

Opay is one the institutions that offer the best lending services. Their app is user-friendly that allows users to instant loans from reliable lenders.

Are you searching for how to borrow money from Opay App? We will teach you how to apply for an Opay Merchant loan without BVN, How to use your smartphone to apply for an Opay loan, etc. Stay connected and read this article to the end to not miss out on important information.

An Overview

One of the reputable mobile Apps that provides online banking and financial services in Nigeria is Opay. You can access several financial services including Loans from the app.

As a potential Opay mobile app user, there are so many opportunities for you to save money, make free transfers, receive funds, buy airtime, pay bills, and enjoy free daily cashback.

How Do Opay Loan Services Work?

Opay offers a platform that houses multiple loan companies, rather than operating as a standalone loan provider. With Opay app, users can access collateral-free instant loans from various loan companies.

Through this service, individuals have the opportunity to secure credit loans without needing collateral, like renowned Nigerian loan companies like Easemoni and Okash. These companies give low-interest loans through their online platforms, facilitated by Opay.

The process of applying for an Opay Merchant loan is straightforward, users are required to hold an account with the platform. Nonetheless, it is important to note that there are additional prerequisites in place.

Eligibility Criteria for Opay Merchant Loan in Nigeria

Before you are eligible for an Opay merchant loan, there are some requirements you must meet. These criteria are given below:

- You must be a Nigerian citizen.

- You must have a valid Opay account.

- You must have a valid Bank Verification Number (BVN).

- You must be in the age range of 20 and 55

- You must have an ID ( a National ID card, driver’s license, or international passport). Either will do.

- You must have a good credit history.

If you meet the above-stated requirements, you can then proceed to apply for the Opay merchant loan. The proceed is quick and easy, once your application is approved the funds will be deposited into your bank account within 24 hours.

The Best Way to Apply for Opay Merchant Loan in Nigeria

All eligible candidates who want to apply for an Opay Merchant loan in Nigeria should follow the steps to successfully send in their applications.

- Open your Opay App.

- Log in to your Opay account or create an account if you just open the app.

- Scroll to the bottom of the home page to click on the “finance” tab

- Select the “loan” option.

- Choose between Okash and Easemoni and proceed to download it.

- Fill out the application form carefully with your information including your name, phone number, and address.

- Apply to your current limit or you choose the loan amount you want to borrow.

- Crosscheck your application and click on ‘submit’.

- Your application will be reviewed and a message will be sent to you showing the approval or rejection within a few minutes or hours.

- You will receive the money in the account you enter if the loan is approved.

Before submitting the application, carefully read through the terms and conditions to know the penalties for defaulters of loans on Opay.

Opay Loan USSD Code

Individuals who don’t have a smartphone or PC can use the Opay loan USSD code to apply for the Merchant loan.

However, the steps used in applying for an Opay merchant loan through the Opay USSD code are given below:

- With the phone number used in registering your Opay account, dial *955#

- Select the “loan” option

- Follow the prompt and apply for a loan.

- The money will be disbursed into your account.

Opay Loan Interest Rate

The Opay loan interest rate is determined by the loan service used. For example, Easemoni’s loan interest rate ranges from 5 to 20% while Okash’s ranges from 3 to 30%.

Opay interest rates are not determined, they may be higher or lower depending on your credit score. Additionally, please note that failure to pay back your loan on time could result in an increase in the interest rate associated with your loan.

How to Pay Back the Opay Merchant Loan

There are several options to pay back your Opay merchant loan. We have mentioned them in this section, continue reading to see. However, ways to pay back your Opay loan include:

Payback using your Opay balance

You can use your Opay balance to pay back your loan by clicking on the ‘repay’ button on the loan details page.

Given that both Easemoni and Okash are no longer integrated within the Opay app, you have the option to settle your loans through the apps by simply transferring the loan amount to the provided account number indicated on the loan repayment page.

Automated Direct Debit (ADD)

This option enables users to establish automated loan repayments utilizing their bank account particulars, such as ATM card information or account number.

Please bear in mind that any failure in repaying your loan by the due date could lead to additional fees, subsequently influencing your credit score.

Benefits of Opay Loan

- Opay Merchant loan is fast and easy. Once the loan is approved you will receive the money in your account within some minutes.

- Flexible repayment loan options

- No collateral is needed unlike conventional banks

- Low-interest rates

Other Things you Should Know About Opay Merchant loan

- The maximum loan amount is N1 million.

- The loan term is 3 to 6 months.

- The interest rate is 15% per annum.

- There is a processing fee of N1,000.

However, we hope this content helps, bookmark this page or comment using the comment box if you have any questions regarding The Best Way to Apply for Opay Merchant Loan in Nigeria (2023). Feel free to share this article or join our Telegram channel to access additional informative content and stay updated with our daily recruitment news.

Related Post:

Show some love 💚💚 by sharing this article