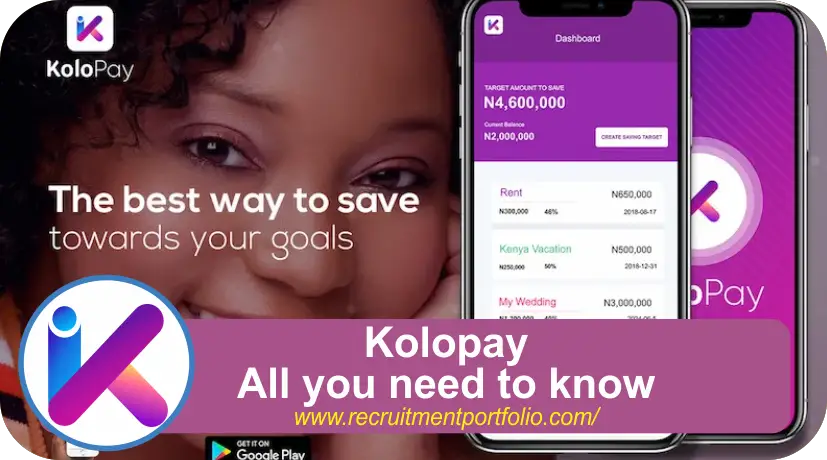

Kolopay – All you need to know in 2024

Kolopay – All you need to know

This article highlights and explains all you need to know about Kolopay, how it works, requirements, and saving and withdrawal methods.

For years now, many Nigerians have been enhancing their savings habits through various platforms, including Kolopay, which simplifies the process of achieving financial goals and managing money effectively. So, I advise you to stay close until the end of this article.

Before going into the main discussion, I’d like you to know that KoloPay was founded on December 4, 2017. The site is a savings platform that simplifies and encourages regular savings.

It operates an e-commerce store and offers direct purchases, making it a valuable tool for individuals to manage their finances and prepare for unexpected expenses or uncertainties. Kolopay was founded by Ayoola Ogunnowo and Ifeoluwa Popoola.

As we all know, saving is a crucial value for individuals to prepare for unpredictable crises such as job loss, health issues, and unfavorable government policies.

Lucky for you, Kolopay is that platform where you can save your money and gain a bigger interest in the end. I would also like to say KoloPay is a mobile piggy bank designed to help individuals develop and maintain a saving culture by nominally saving towards future goals.

So, you don’t need to worry, as I’m going to carefully explain in this article all you need to know about Kolopay and other important information.

What is KoloPay all about?

In simple and understandable terms, KoloPay is a free mobile and web application that helps users save money towards their goals, offering no hidden charges or monthly fees.

Check These Out:

An Overview of KoloPay

Kolopay is a mobile and web application that allows users to target savings over a specific period and receive discounts on goods and services they save towards, enabling them to make desired purchases.

Furthermore, the digital platform (Kolopay) partners with reputable merchants to facilitate easy purchases of goods and services, offering a variety of options through the app and allowing users to save on their purchases.

Is KoloPay Safe?

This is one of the questions thousands of people have been asking for years now. With my experience and knowledge about Kolopay, I’ll do well to respond to this question. The safety of KoloPay is unclear due to limited online information.

Despite a 3.4/5 rating on the Google Play Store, my advice is that you should conduct thorough research before using the app, as users should understand the platform’s security measures and user feedback.

The following are the major features you’ll experience on the platform:

- User-Friendly Interface: A fintech app should have a user-friendly interface, allowing seamless navigation and access to various functions through clear menus and options.

- Security Measures: The system employs robust security measures like two-factor authentication and biometric login options to safeguard users’ sensitive financial data and transactions.

- Convenient Transactions: The app’s utility is enhanced by its ability to facilitate transactions such as payments, transfers, and investments directly from the app.

- Real-Time Notifications: Real-time updates on account activities, transaction updates, and potential security alerts enhance the user experience and prevent unauthorized activities.

Services Available on KoloPay Platform

The app provides a digital platform for saving towards specific goals, offering additional benefits such as:

1. AutoSave

Your account can be configured to automatically save a specific amount of money on a daily, weekly, or monthly basis.

2. EasySave and Multiple Goals

The platform, without mixing words, offers an easy saving method, allowing users to save any amount at their convenience and plan to save towards multiple goals simultaneously, such as car, rent, and school fees.

3. Koloshare

The Koloshare feature enables users to invite individuals to contribute towards their goals, akin to crowdfunding.

In summary, the digital app uses encryption to protect your personal information and offers a 10% annual interest rate.

Requirements needed to use Kolopay

Kolopay has specific qualifications/requirements for potential customers, such as:

- Interested persons must be Nigerian citizens or legal residents of Nigeria.

- Interested persons must be up to 18 years of age.

- Interested persons must possess a valid and legal means of identification such as a NIN, driver’s license, international passport, etc.

- Interested persons must have the right to a bank account.

How to register for KoloPay

To register on the website, follow these steps:

- Visit https://www.kolopay.com/register

- You need to complete the three basic steps on the page, which are Personal Information, Verification, and success

- Personal information is the creation of your account.

- Once the page opens, provide your valid details in the space provided.

- And then click on Register.

- Once registration is completed, you will be requested to verify your account via email and then proceed to the success page.

How It Works

1. Create an Account

As interested persons, to access Kolopay, you must first sign up and simply provide your full name, number, email address, and password.

2. Setup Saving Goals

Create a savings goal with a name and desired amount, and set a withdrawal date.

3. Start Saving

Connect your debit card to your savings goal and begin saving immediately.

4. Grow Your Savings

At this point, you will start enjoying KoloPay offers of up to 10% interest on savings.

Kolopay Contact Information

Contact Address: 3, joel ogunnaike street GRA Ikeja.

Telephone: (+234) 708 554 4250

Email Address: info@kolopay.com

Website: www.kolopay.com

Recommended

- List of Companies in Uyo with Address – Uyo top Companies

- Oil and Gas Companies that Accept Nigerian Students for Industrial Training

- Full List of Companies that Accept SIWES Students in Nigeria

- 50 Companies where Accounting Graduates can Work in Nigeria

- List of Companies in Aba with Address – Aba top Companies

- List of Companies in Lagos with Address – Lagos top Companies

- List of Companies in Jos with Address – Jos top Companies

- List of Companies in Calabar with Address – Calabar’s top Companies

- Full List of Foreign and International Companies in Nigeria

- Shipping Companies from USA to Nigeria

- Top Tech Companies in Nigeria

- Top Shipping Companies in Nigeria

- List of Manufacturing Companies in Nigeria

- List of Public Companies in Nigeria

- TOP 25 COMPANIES THAT RECRUIT REMOTE WORKERS

- List of Investment Companies Registered with SEC in Nigeria